How To Record An Asset In Xero . record and update your assets. learn how to use the fixed asset register on xero, including adding asset types, setting depreciation rates,. If you have fixed assets that you want to track in xero,. the purchase of equipment (fixed asset) of $150,0000.00 plus $7500.00 gst was made by providing the seller with a deposit of. in xero, fixed assets support customers with running depreciation calculations and reporting. Track business assets such as vehicles, machinery, hardware and office equipment. set up a register to record and depreciate your fixed assets in xero. Import all your fixed assets into. there are three sections: 28k views 5 years ago fixed assets.

from www.chargebee.com

set up a register to record and depreciate your fixed assets in xero. If you have fixed assets that you want to track in xero,. the purchase of equipment (fixed asset) of $150,0000.00 plus $7500.00 gst was made by providing the seller with a deposit of. 28k views 5 years ago fixed assets. there are three sections: in xero, fixed assets support customers with running depreciation calculations and reporting. record and update your assets. Import all your fixed assets into. learn how to use the fixed asset register on xero, including adding asset types, setting depreciation rates,. Track business assets such as vehicles, machinery, hardware and office equipment.

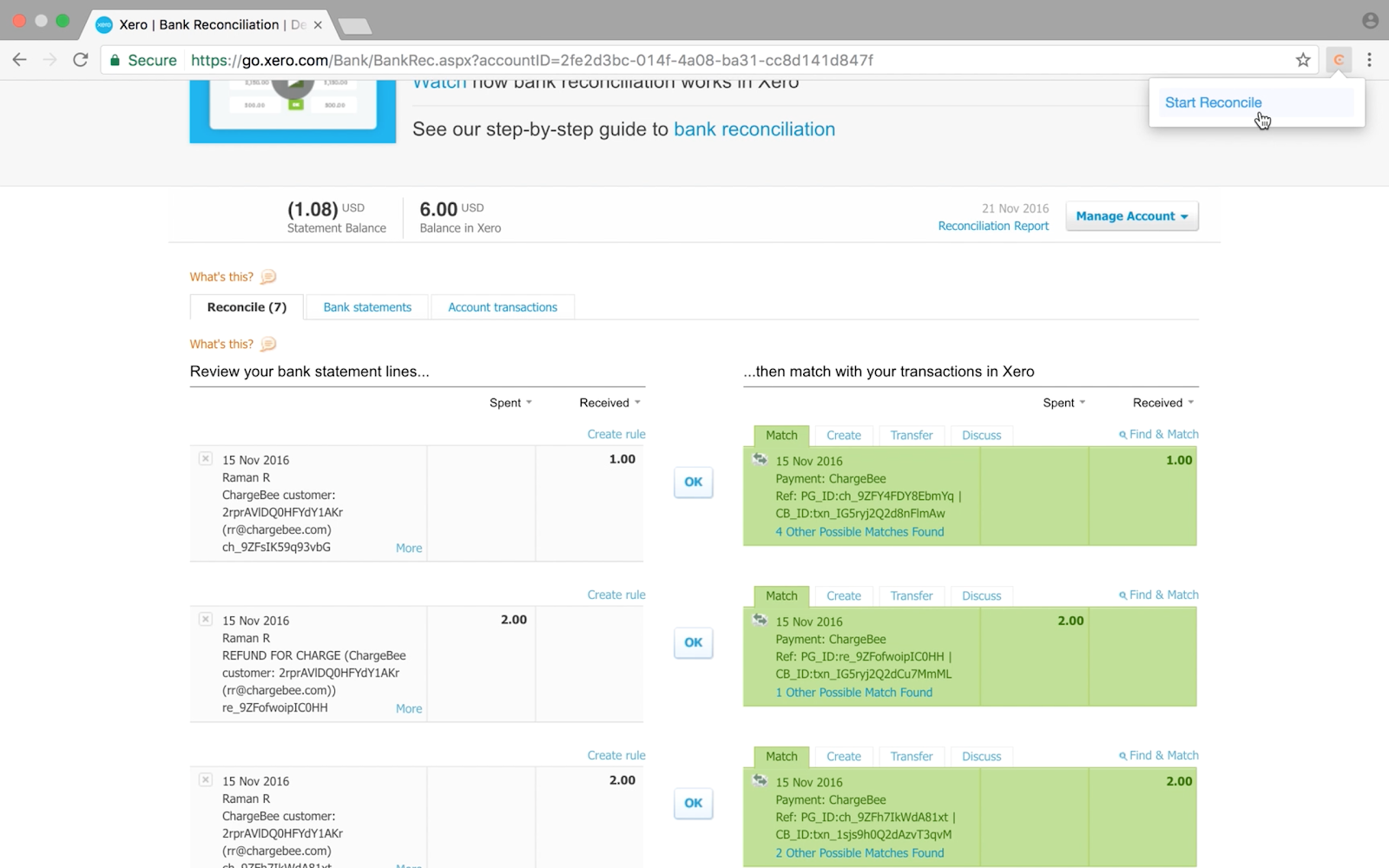

Reconciling Chargebee Invoices with Xero Chargebee Docs

How To Record An Asset In Xero the purchase of equipment (fixed asset) of $150,0000.00 plus $7500.00 gst was made by providing the seller with a deposit of. learn how to use the fixed asset register on xero, including adding asset types, setting depreciation rates,. Import all your fixed assets into. in xero, fixed assets support customers with running depreciation calculations and reporting. 28k views 5 years ago fixed assets. record and update your assets. set up a register to record and depreciate your fixed assets in xero. there are three sections: the purchase of equipment (fixed asset) of $150,0000.00 plus $7500.00 gst was made by providing the seller with a deposit of. Track business assets such as vehicles, machinery, hardware and office equipment. If you have fixed assets that you want to track in xero,.

From coursecloud.org

Xero Chart of Accounts What you Need to Know Course Cloud How To Record An Asset In Xero Import all your fixed assets into. in xero, fixed assets support customers with running depreciation calculations and reporting. the purchase of equipment (fixed asset) of $150,0000.00 plus $7500.00 gst was made by providing the seller with a deposit of. there are three sections: set up a register to record and depreciate your fixed assets in xero.. How To Record An Asset In Xero.

From avers.com.au

How to set up and use Xero Inventory Properly How To Record An Asset In Xero learn how to use the fixed asset register on xero, including adding asset types, setting depreciation rates,. set up a register to record and depreciate your fixed assets in xero. record and update your assets. If you have fixed assets that you want to track in xero,. there are three sections: the purchase of equipment. How To Record An Asset In Xero.

From theusualstuff.com

A Simple Guide to Xero Fixed Asset Depreciation and Disposal The How To Record An Asset In Xero Import all your fixed assets into. If you have fixed assets that you want to track in xero,. there are three sections: set up a register to record and depreciate your fixed assets in xero. Track business assets such as vehicles, machinery, hardware and office equipment. the purchase of equipment (fixed asset) of $150,0000.00 plus $7500.00 gst. How To Record An Asset In Xero.

From avers.com.au

How to set up and use Xero Inventory Properly How To Record An Asset In Xero there are three sections: in xero, fixed assets support customers with running depreciation calculations and reporting. the purchase of equipment (fixed asset) of $150,0000.00 plus $7500.00 gst was made by providing the seller with a deposit of. learn how to use the fixed asset register on xero, including adding asset types, setting depreciation rates,. 28k views. How To Record An Asset In Xero.

From www.xenonconnect.com

How do I record a customer deposit in Xero? Xenon Connect How To Record An Asset In Xero If you have fixed assets that you want to track in xero,. set up a register to record and depreciate your fixed assets in xero. learn how to use the fixed asset register on xero, including adding asset types, setting depreciation rates,. there are three sections: record and update your assets. 28k views 5 years ago. How To Record An Asset In Xero.

From www.ocerra.com

Automate Xero transactions using AP Automation software How To Record An Asset In Xero If you have fixed assets that you want to track in xero,. there are three sections: the purchase of equipment (fixed asset) of $150,0000.00 plus $7500.00 gst was made by providing the seller with a deposit of. set up a register to record and depreciate your fixed assets in xero. learn how to use the fixed. How To Record An Asset In Xero.

From www.youtube.com

How to record right of use assets and lease liabilities in Xero YouTube How To Record An Asset In Xero Track business assets such as vehicles, machinery, hardware and office equipment. record and update your assets. the purchase of equipment (fixed asset) of $150,0000.00 plus $7500.00 gst was made by providing the seller with a deposit of. there are three sections: Import all your fixed assets into. learn how to use the fixed asset register on. How To Record An Asset In Xero.

From ufreeonline.net

50 How To Record Fixed Assets How To Record An Asset In Xero If you have fixed assets that you want to track in xero,. Import all your fixed assets into. set up a register to record and depreciate your fixed assets in xero. there are three sections: the purchase of equipment (fixed asset) of $150,0000.00 plus $7500.00 gst was made by providing the seller with a deposit of. Web. How To Record An Asset In Xero.

From www.youtube.com

Cash Transaction in Xero YouTube How To Record An Asset In Xero record and update your assets. in xero, fixed assets support customers with running depreciation calculations and reporting. the purchase of equipment (fixed asset) of $150,0000.00 plus $7500.00 gst was made by providing the seller with a deposit of. learn how to use the fixed asset register on xero, including adding asset types, setting depreciation rates,. Web. How To Record An Asset In Xero.

From vintti.com

How to Record Assets in Xero Tracking Your Valuable Resources How To Record An Asset In Xero record and update your assets. the purchase of equipment (fixed asset) of $150,0000.00 plus $7500.00 gst was made by providing the seller with a deposit of. 28k views 5 years ago fixed assets. in xero, fixed assets support customers with running depreciation calculations and reporting. there are three sections: Track business assets such as vehicles, machinery,. How To Record An Asset In Xero.

From www.youtube.com

Xero Balance Sheet What to Look For Accounting Clarity for How To Record An Asset In Xero the purchase of equipment (fixed asset) of $150,0000.00 plus $7500.00 gst was made by providing the seller with a deposit of. set up a register to record and depreciate your fixed assets in xero. Track business assets such as vehicles, machinery, hardware and office equipment. in xero, fixed assets support customers with running depreciation calculations and reporting.. How To Record An Asset In Xero.

From www.youtube.com

Xero Tutorial 13 Recording Bank Payments and Receipts YouTube How To Record An Asset In Xero If you have fixed assets that you want to track in xero,. there are three sections: learn how to use the fixed asset register on xero, including adding asset types, setting depreciation rates,. Import all your fixed assets into. in xero, fixed assets support customers with running depreciation calculations and reporting. record and update your assets.. How To Record An Asset In Xero.

From www.xero.com

Manage fixed assets Xero AU How To Record An Asset In Xero the purchase of equipment (fixed asset) of $150,0000.00 plus $7500.00 gst was made by providing the seller with a deposit of. 28k views 5 years ago fixed assets. set up a register to record and depreciate your fixed assets in xero. record and update your assets. in xero, fixed assets support customers with running depreciation calculations. How To Record An Asset In Xero.

From precoro.com

How to invoice in Xero How To Record An Asset In Xero record and update your assets. there are three sections: set up a register to record and depreciate your fixed assets in xero. Import all your fixed assets into. Track business assets such as vehicles, machinery, hardware and office equipment. If you have fixed assets that you want to track in xero,. in xero, fixed assets support. How To Record An Asset In Xero.

From www.xero.com

Manage Fixed Assets Xero AU How To Record An Asset In Xero record and update your assets. set up a register to record and depreciate your fixed assets in xero. in xero, fixed assets support customers with running depreciation calculations and reporting. there are three sections: learn how to use the fixed asset register on xero, including adding asset types, setting depreciation rates,. Track business assets such. How To Record An Asset In Xero.

From www.youtube.com

Xero How to Record the Loan on Car Purchase YouTube How To Record An Asset In Xero the purchase of equipment (fixed asset) of $150,0000.00 plus $7500.00 gst was made by providing the seller with a deposit of. set up a register to record and depreciate your fixed assets in xero. in xero, fixed assets support customers with running depreciation calculations and reporting. 28k views 5 years ago fixed assets. Track business assets such. How To Record An Asset In Xero.

From avers.com.au

How to manage tax, BAS and PAYG liabilities in Xero How To Record An Asset In Xero in xero, fixed assets support customers with running depreciation calculations and reporting. If you have fixed assets that you want to track in xero,. the purchase of equipment (fixed asset) of $150,0000.00 plus $7500.00 gst was made by providing the seller with a deposit of. there are three sections: Track business assets such as vehicles, machinery, hardware. How To Record An Asset In Xero.

From www.xero.com

Manage Fixed Assets Xero AU How To Record An Asset In Xero the purchase of equipment (fixed asset) of $150,0000.00 plus $7500.00 gst was made by providing the seller with a deposit of. Import all your fixed assets into. set up a register to record and depreciate your fixed assets in xero. If you have fixed assets that you want to track in xero,. in xero, fixed assets support. How To Record An Asset In Xero.